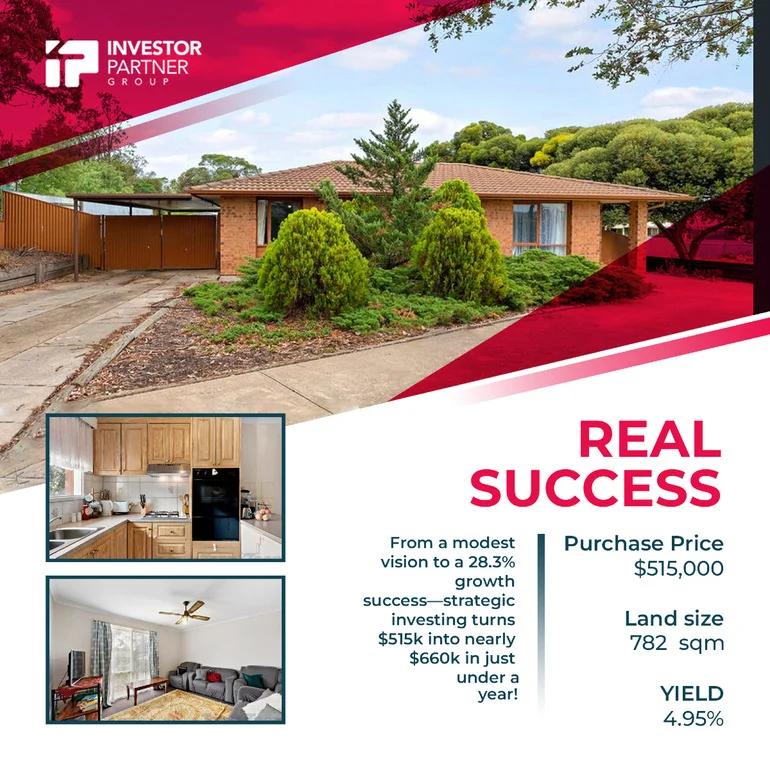

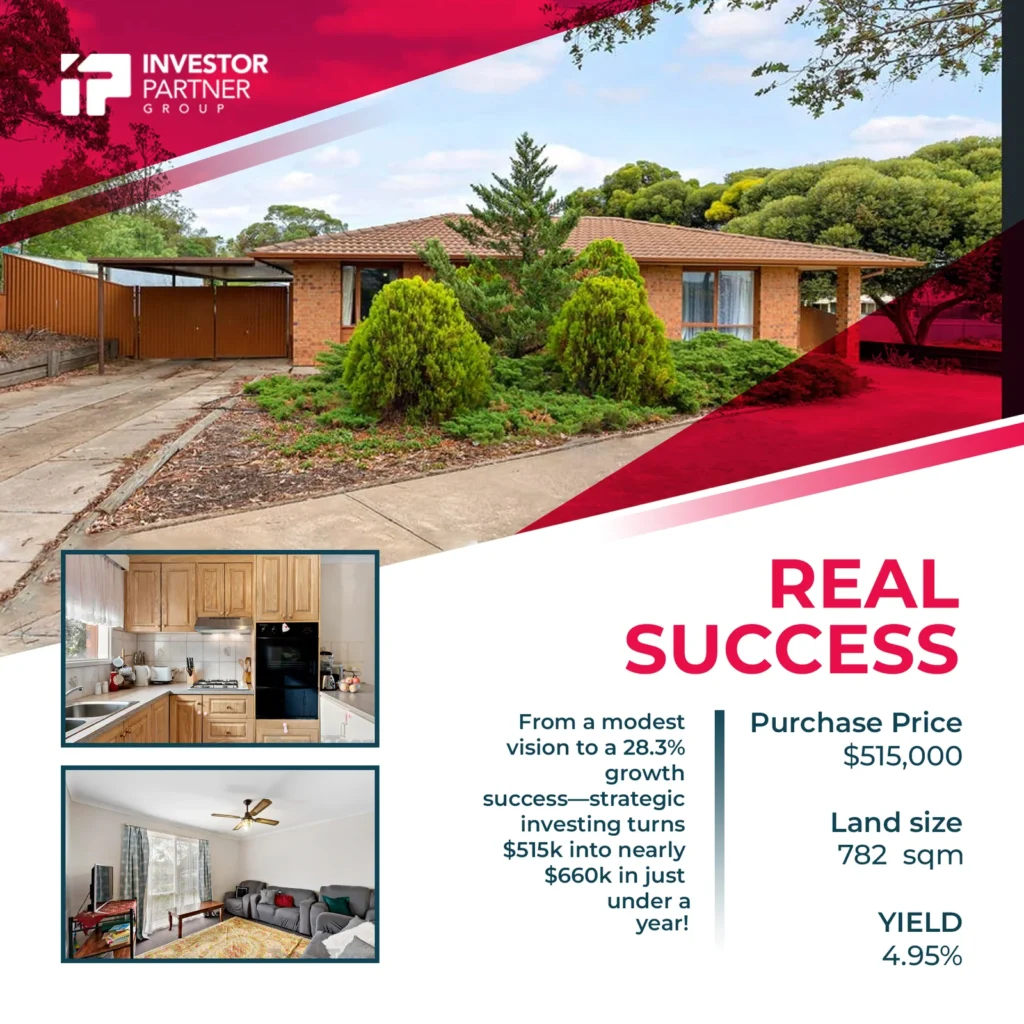

A Corner Block That Paid Off Big – Turning $515K into $660K

Purchase Price

$515,000

Est Value

$660,000

Land Size

782 sqm

Yield

4.95%

In late December 2023, our client made a bold move by acquiring a property in Metro Adelaide for $515,000. Fast forward less than a year, and this investment has soared in value by a staggering 28.3%, now approaching nearly $660,000. This isn’t just a stroke of luck—it’s the result of a carefully crafted, strategic approach to property investing.

When the client first approached us, they had their eyes set on Melbourne, considering a development block where they could live in an old house and potentially develop another at the back.

While this could work for some, we saw a different opportunity that aligned better with their long-term goals as a business owner using his business to build assets. We recommended a more calculated start in Adelaide, suggesting a property that could deliver growth while remaining a secure investment.

The client’s $100,000 investment quickly transformed into $250,000—an eye-popping 150% return—setting the stage for even bigger wins in the future.

The property sits on a 782 sqm corner block, offering immense potential for development. Whether retaining the existing house and building a side dwelling or developing up to three townhouses, this asset is brimming with opportunities. With a yield of around circa 5%, a prime location just 26 km from Adelaide’s CBD, and easy access to the beach, train station, and shopping hubs, it’s clear why this property is positioned for impressive growth.

The surrounding area is experiencing rapid expansion, making it one of the most sought-after regions in the market.

This property is located in a high-growth corridor, and the numbers speak volumes. The demand is outpacing supply at a ratio of 52, meaning more people are looking for properties than there are available. Days on the market have dropped dramatically from 73 to under 45, indicating strong buyer interest. The market is tight, with stock levels at less than 0.2%, and rental demand is solid, with 21% of the population renting and vacancy rates staying incredibly low at under 0.1%.

This success story is just one example of how a strategic approach to property investment can unlock significant returns. If you’re ready to make your next smart move in the property market, let’s connect and explore how we can achieve similar results for you. Until then —peace out!