An Exceptional Journey Of Property Acquisition For A First-Time Investor

Purchase Price

$360,000

Est Value

$390,000

Land Size

801 sqm

Yield

7.08%

An exceptional property acquisition at our dearest clients. This property acquisition is actually a testament to how we assist our clients to accomplish this in a dynamic high-inflation environment!

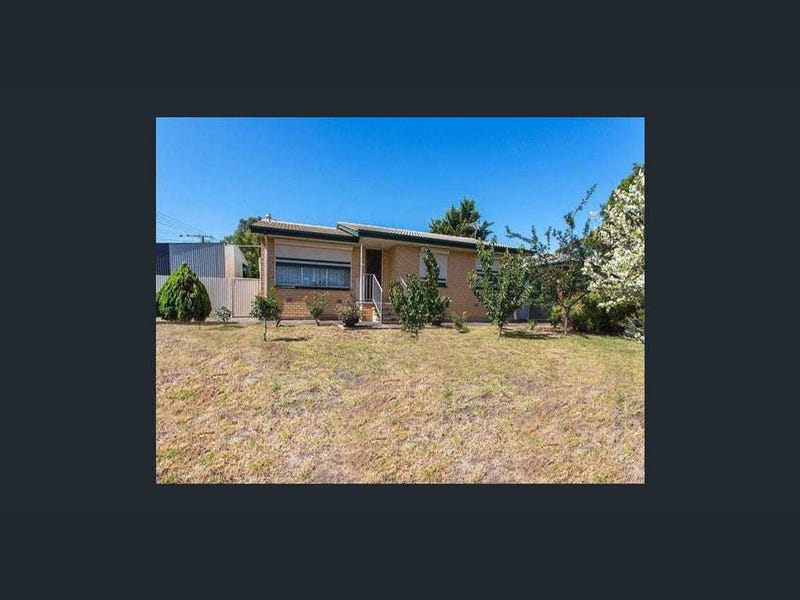

This property is nestled in a homeowner-occupied neighborhood, offering stability and potential for growth. The other properties in the same locality are being sold at a higher price constituting a strong bank valuation validating the investment. Notably, the property sits on a spacious 801 sqm corner lot, ripe with potential for future subdivision, adding to its long-term value.

Its prime location places it just 5 minutes away from schools, a golf club, hospitals, childcare facilities, and places of worship. Additionally, a major shopping center is a mere 3-minute drive away.

Our client, Kevin, faced the common challenges of a first-time investor. With limited initial savings of $30,000 and an annual income of approximately $80,000, he was eager to enter the property market promptly while maintaining a conservative acquisition cost. In his late twenties, Kevin was committed to building his investment portfolio wisely.

We assisted Kevin in crafting a savings strategy, helping him accumulate the required $60,000 deposit within a mere 3 months to secure his first property. Furthermore, we devised a property acquisition plan that aimed to transform his $30,000 savings into a passive income exceeding $200,000 within 7 years. With a focus on cash flow and growth in the foundational stages of property investment, Kevin has already witnessed impressive equity growth, amassing a 16.67% increase in his equity, setting the stage for his second property acquisition.

Here’s why we believe this property is situated in a burgeoning growth corridor, backed by compelling data:

• Demand surpasses supply with a demand-supply ratio of 57, indicating high desirability.

• The property spends minimal time on the market, with days on the market reduced from 128 to under 47 days.

• A low stock-on-market percentage of less than 1.3% signifies limited competition.

• The proportion of renters stands at 36.2%, highlighting strong rental demand.

• A vacancy rate under 0.72% and declining further underscores the property’s attractiveness to tenants.

The acquisition of this exceptional property in the thriving growth corridor exemplifies a wise investment move. Our esteemed client has not only harnessed the potential for substantial capital appreciation but has also crafted a strategy to enhance yields significantly, thereby securing their financial well-being.

Stay connected for more success stories as we continue to assist people in building their property portfolios and prospering ahead in life.