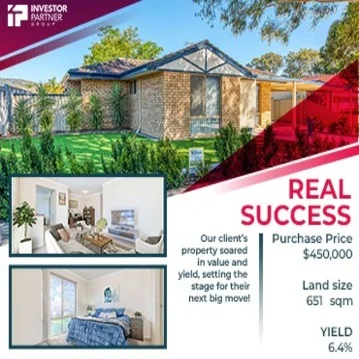

Retirement in Sight: How One Investor Achieved a 34.9% Property Growth in Under a Year

Purchase Price

$415,000

Est Value

$560,000

Land Size

1,003 sqm

Yield

6.45%

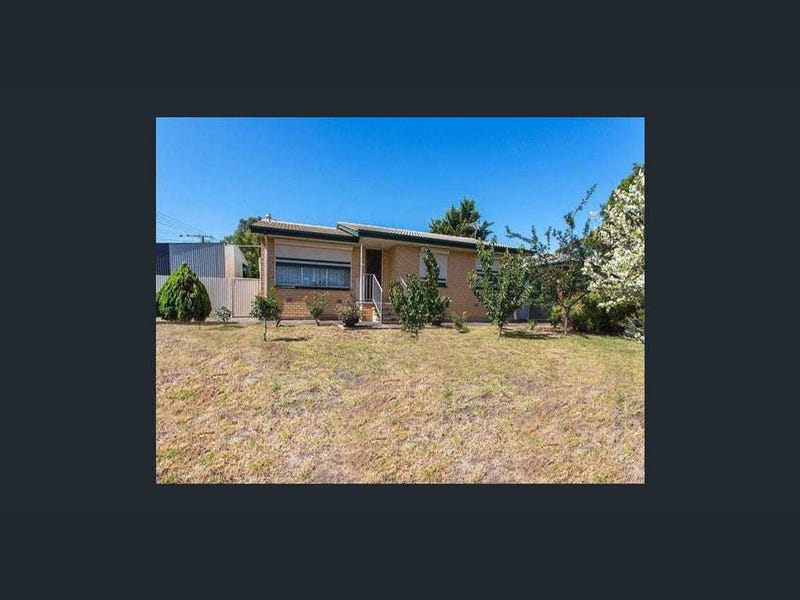

In early 2024, a prime property in Metro Perth was secured for $415,000, and in a short span, its value has surged by an impressive 34.9%, reaching nearly $560,000. This isn’t just a story of numbers; it’s a testament to what’s possible when a well-thought-out strategy meets decisive action, even in a fiercely competitive market. The property, sitting on a generous 1,003 sqm corner lot, offers current value and significant future potential. With the ability to either build four units or retain the existing house and construct two additional dwellings at the rear, the investment is both versatile and future-proof.

This success story isn’t just about a property—it’s about a Brisbane-based client with a dream to retire in six years. After spending over five years overseas, away from family and facing financial hurdles with limited lending options, he felt stuck. But everything changed with the right strategy. We didn’t just focus on acquiring one good property; we built a roadmap to create a robust asset base. In less than a year, he went from owning zero properties to three, setting him firmly on the path to financial freedom.

The Metro Perth property wasn’t just a purchase but a calculated decision. With rental income generating $515 per week and a yield of 6.45%, the cash flow was strong from day one. Its location further amplified its appeal. A short walk away lies a serene lake, multiple playgrounds, and both primary and secondary schools. Nearby parks and two shopping centres add layers of convenience, while the beach is just a 12-minute stroll away. Commuting to the city is seamless, thanks to direct access via two major arterial roads. Every aspect of this property screamed long-term value.

The demand-supply ratio stands at 58, signalling significantly higher demand than the available supply. Properties are now being snapped up in under 19 days—dramatically improving from the previous average of 86 days. The stock on the market is critically low, sitting below 0.2%, further emphasizing scarcity in this high-demand area. Rental demand remains robust, with renters making up 32% of the local demographic and vacancy rates dipping below an astonishing 0.12%. These aren’t just market statistics—they’re indicators of future growth and sustained demand.

For our client, this property became the turning point. From struggling to secure a single investment to owning three properties in under a year, his story is a shining example of what’s achievable with a clear vision, expert guidance, and strategic execution. It’s a reminder to every aspiring investor: opportunities exist, but they favour those bold enough to seize them.

Until the next success story—stay motivated, stay bold, and let’s make it happen together. Peace out!