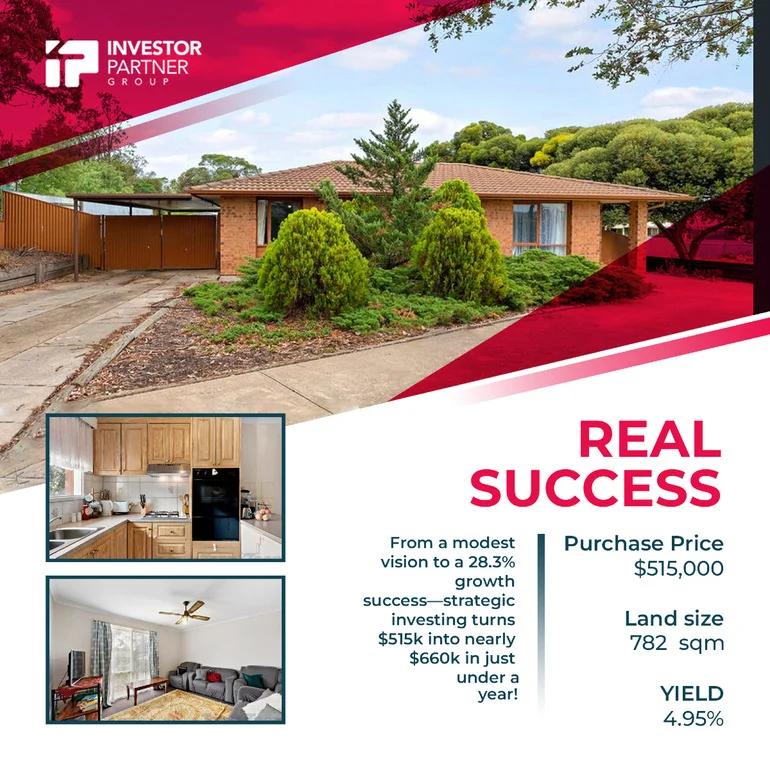

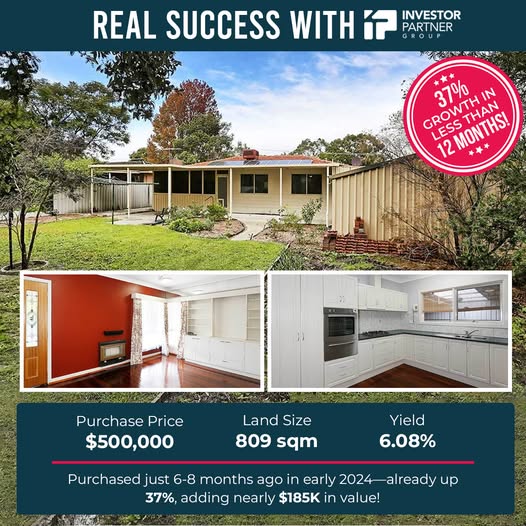

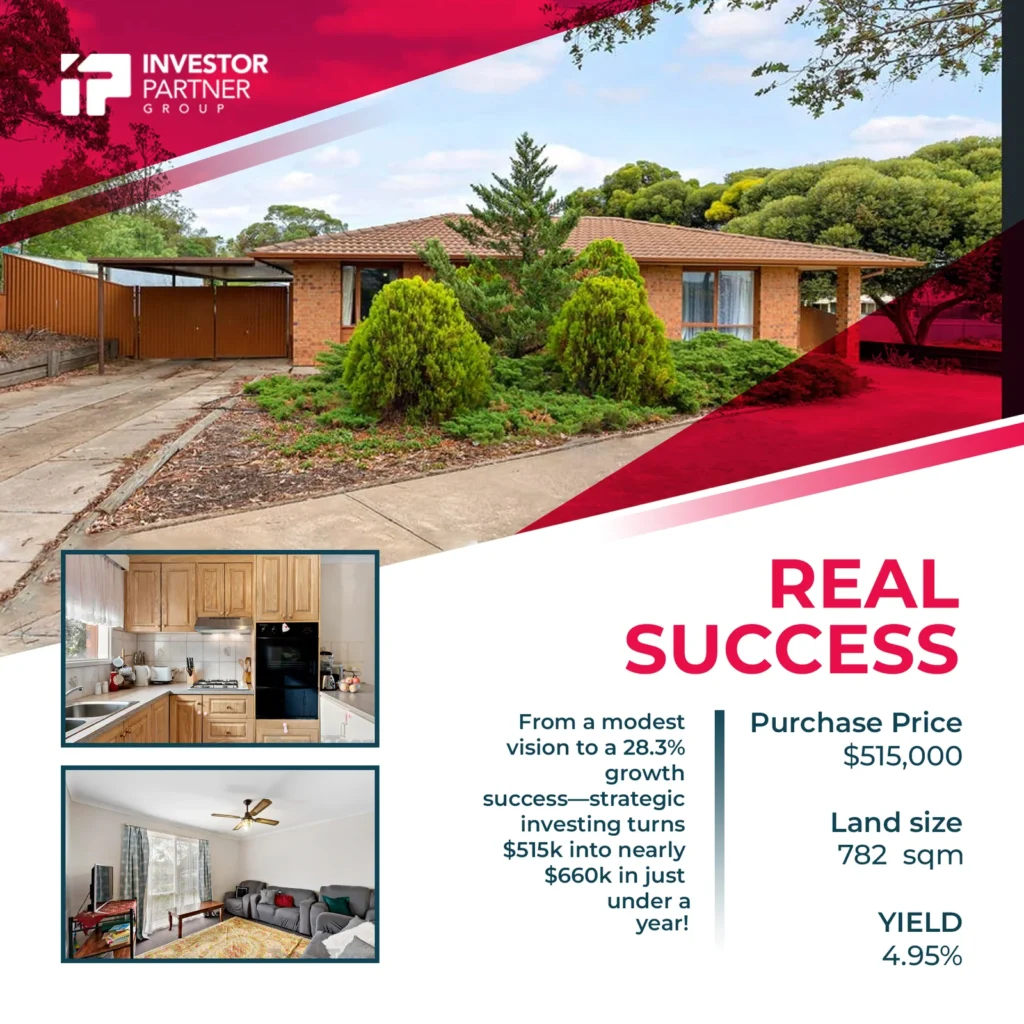

Seaside Success: Unlocking $100K Growth in 5 Months – Turn Market Data into Property Success

Purchase Price

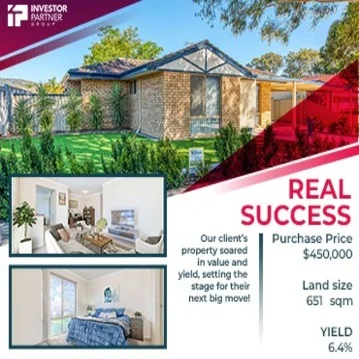

$450,000

Est Value

$550,000

Land Size

651 sqm

Yield

6.4%

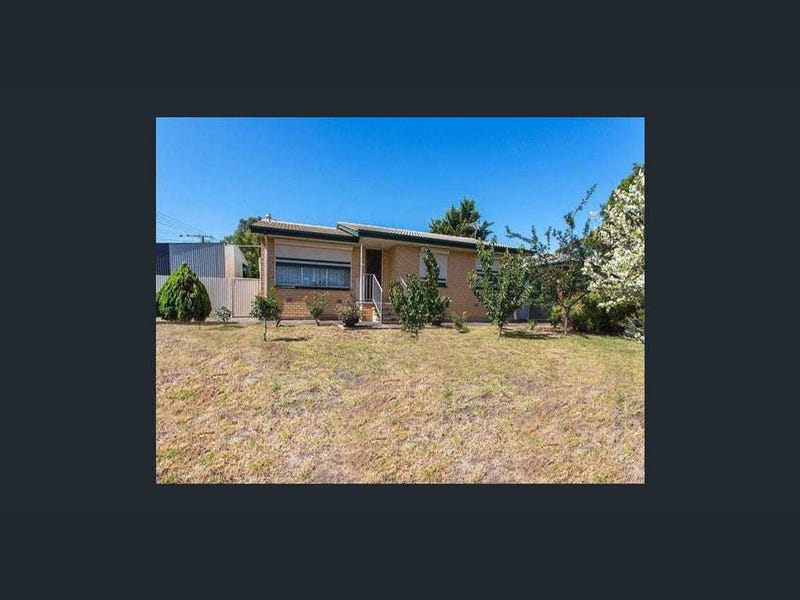

Our client’s property investment journey took a remarkable turn after we helped restructure their portfolio. Previously, one of their properties had underperformed for over four years, but within just five months of acquiring a new $450,000 property in Perth’s growth corridor, they saw over $100,000 in value appreciation, with the property now valued at more than $550,000.

Sitting on 651 sqm. the site generates a rental income of $550 per week with a 6.4% rental yield. This prime location, with low vacancy rates and high demand, has positioned Hozefa perfectly for their next investment, moving confidently toward their retirement goals.

Prime Location:

Purchased at $450k, this 651 sqm. property can be converted into a dual-income property lot and offers a promising yield of 6.4% with a rental income of $520 per week.

Accessibility to features: Walking distance to school, playground, primary and secondary school, daycare, and shopping village.

Connectivity: A 5-minute drive to the train station

Easy access to the city via direct access through 2 major roads, which is 5 5-minute drive from the place.

In the growth corridor, 100%

The Growth Corridor:

High Demand: A demand-supply ratio of 56 indicates strong demand, with more buyers than available properties.

Quick Sales: Properties here spend 43 days on the market, down from 74 days previously.

Limited Supply: Stock on the market is less than 0.12%.

Rental Appeal: Renters comprise 27% of the population, with a vacancy rate under 0.14%.

Are you eager to begin unlocking your investment potential?

Discuss how our client’s success story matches your desire to grow wealth through strategic property investing. Whether you’re investing or looking to diversify your portfolio, our knowledge can help you build significant generational wealth.

Never settle for less; adopt a plan that corresponds with your objectives. Till the next success story, peace out!