Unlocking Substantial Gains Through Strategic Investment

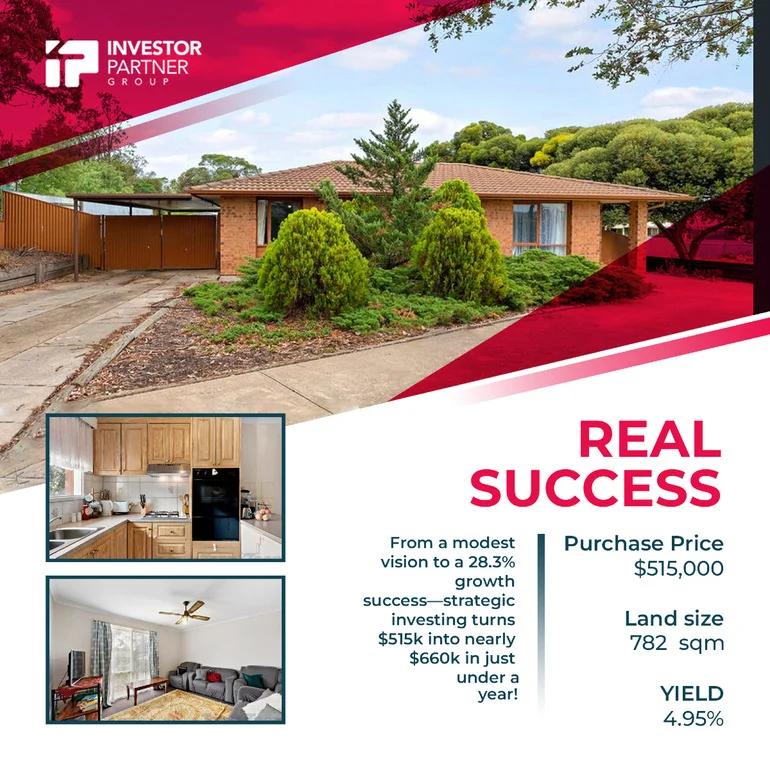

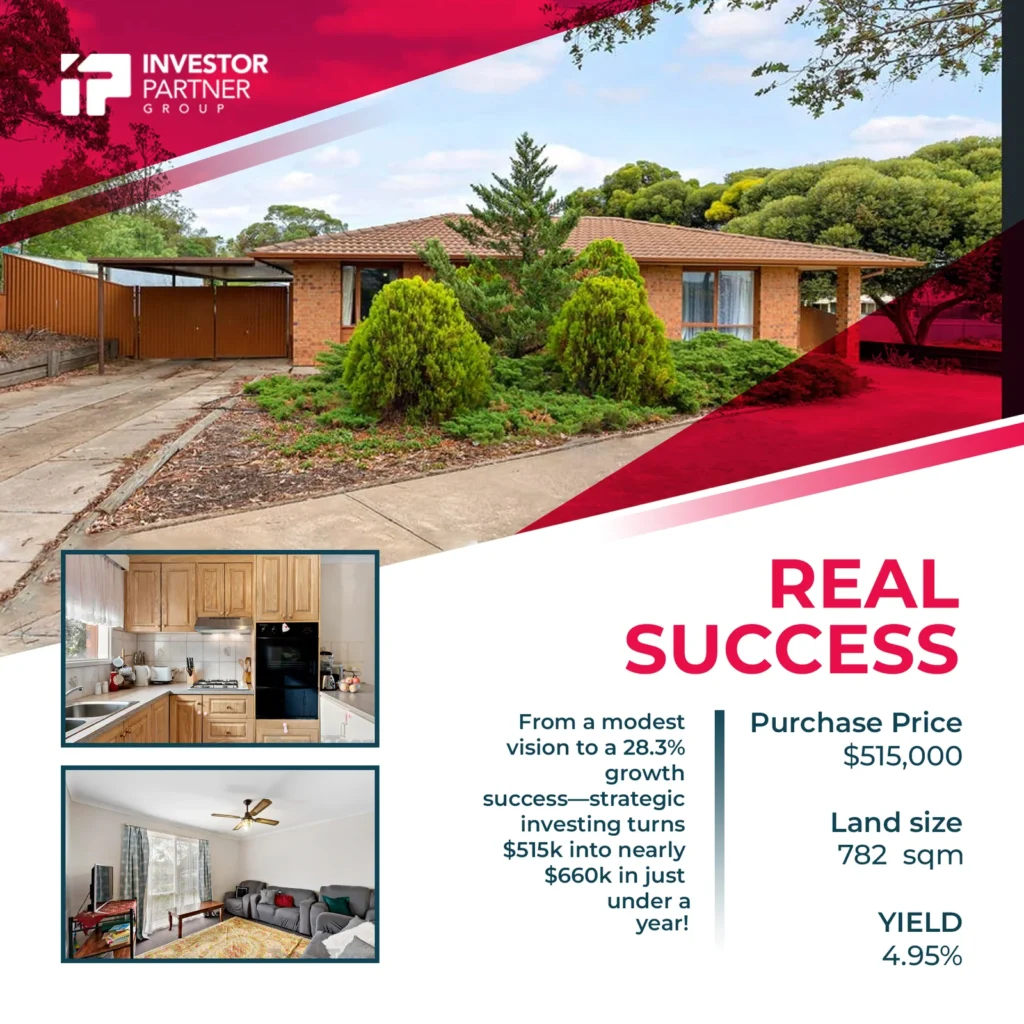

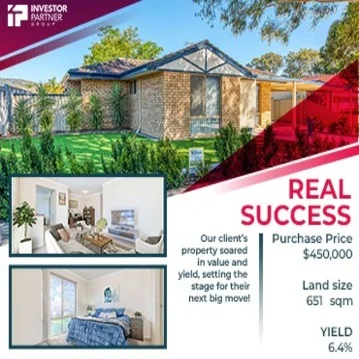

Purchase Price

$405,000

Est Value

Land Size

738 sqm

Yield

5.52%

Our client Rakesh, a visionary investor who seized a golden opportunity in the thriving suburb of Salisbury North, South Australia. This remarkable investment journey is a testament to the power of strategic thinking and expert guidance in the realm of property investment.

Rakesh represents a diligent and hardworking young family consisting of a husband and wife. Their financial discipline and commitment to saving are truly commendable. They embarked on their investment journey at a young age, prioritizing the use of disposable income to rapidly reduce debt. While this strategy is often effective, their previous property purchases did not yield the desired growth outcomes, despite accumulating substantial equity. In collaboration with our team, Rakesh’s family adopted a more effective approach. Through debt recycling and the strategic use of their refinanced equity, they acquired an asset that not only generates cash flow but also offers multiple exit strategies. In just the first six months, they witnessed a remarkable 15.66% growth, achieving an exceptional 78% cash-on-cash return. This success has positioned them to take the next step and acquire their second property, bringing them closer to their goals of achieving passive income and growing their net wealth.

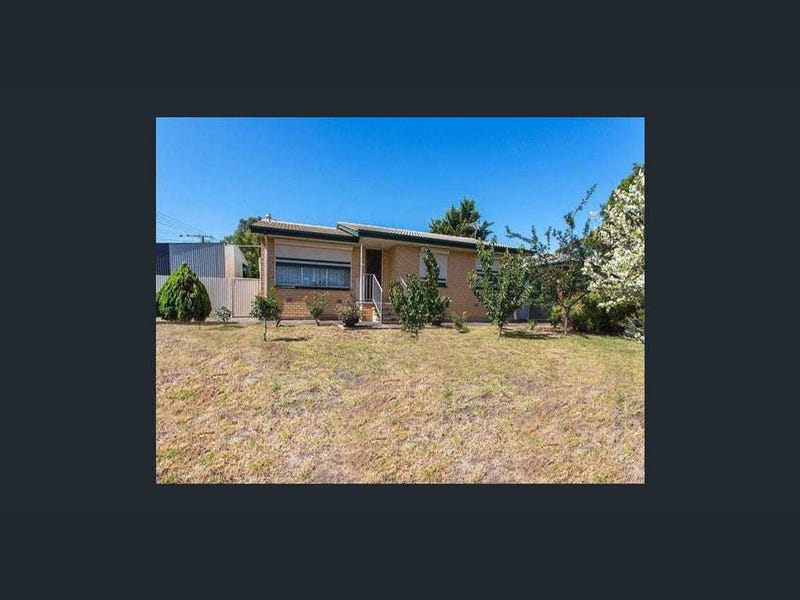

This property represents much more than bricks and mortar; it’s an investment that promises outstanding growth potential and a multitude of strategic options. Rakesh acquired this property at a purchase price of $405,000, securing a generous 738sqm of land. This substantial land size offers a unique proposition: the option to retain the existing house at the front and build another at the rear, or to embark on a more extensive project by replacing the existing structure with three side-by-side houses. The property’s rental income currently stands at $430 per week, resulting in an attractive rental yield of 5.52%.

A Property in Need of TLC:

Rakesh recognized the untapped potential of this property. By investing $15,000 in some much-needed tender loving care (TLC), he not only improved the property’s condition but also significantly boosted its value. Today, the property is appraised at $480,000, reflecting a remarkable appreciation in value.

Situated just 20km from the heart of Adelaide’s CBD, this property offers an ideal balance between suburban tranquility and city accessibility. It’s the kind of location that transcends standard investment expectations. Within walking distance, you’ll find a serene lake, a playground for families, as well as both primary and secondary schools. If you’re a fan of the outdoors, numerous parks are also within easy reach. Additionally, two bustling shopping centers provide convenience for daily needs.

In the Heart of a Growth Corridor:

The investment potential of this property is further emphasized by its location within a 100% growth corridor. This means that, in addition to the immediate benefits, this property is strategically positioned for long-term growth.

Let’s delve into the numbers that underline the investment potential in this growth corridor:

Demand-Supply Ratio: A robust 60, indicating significantly higher demand than supply.

Days on Market: Properties in this area spend an average of fewer than 49 days on the market, a significant improvement from the previous 86 days.

Stock on Market: Less than 0.47%, highlighting strong demand.

Renters Proportion: Approximately 38% of residents are renters, underscoring the consistent demand for rental properties.

Vacancy Rate: Impressively low, standing at less than 0.18%.

This property exemplifies the perfect opportunity to accelerate your investment journey and achieve financial prosperity.