Witnessing a rollercoaster ride from afar and actually being on it are two different experiences. When one says that the Australian property market is akin to a thrilling roller coaster ride, trust me, its way more than just a ride!

The ups and downs in prices, the steep edges known as the policies, and the financial gains and losses; all are part of a package. This dynamic landscape is pebbled with its own highs and lows, making it all the more entertaining.

As per the latest observance, Australia’s housing market is on the cusp of significant growth, driven by factors such as migration, demand dynamics, and anticipated interest rates. If you’re considering entering the property market, acting sooner rather than later might be your best bet to capitalise on the impending surge in property value in Australia.

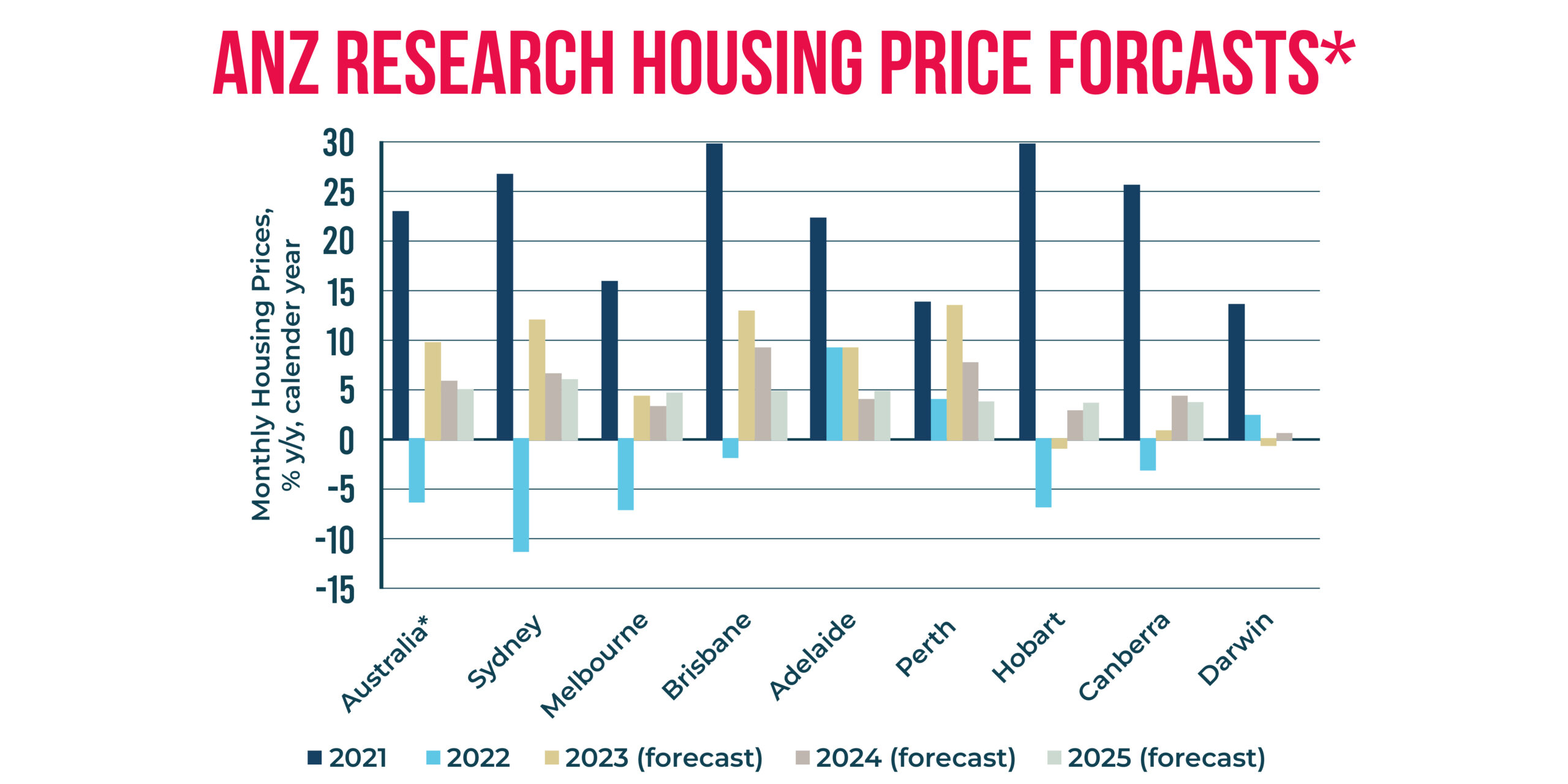

According to Oxford Economics Australia, house prices in Australia are on track to surge by over a third in the next three years. Sydney’s median price is expected to soar past $2 million, with Melbourne and Perth not far behind in joining the million-dollar club. To put this into perspective, the median price in Sydney could rise to an astounding $1.934 million by June 2027.

Have a look at a few city-specific insights mentioned below for a clearer picture of the future.

City-specific Insights

- Sydney: With a median house price tipped to reach $1.934 million in three years, Sydney’s property market remains hot and is bound to soar in the coming years.

- Brisbane: Strong interstate migration into south-east Queensland is expected to boost Brisbane’s property values. The mid-point house price is projected to climb by 32.7% to $1.208 million.

- Melbourne: Despite a slower growth rate since the pandemic, Melbourne’s median house price is forecasted to rise by 36.7% to $1.278 million.

- Perth: Australia’s best-performing market over the past year, is expected to continue its boom. The median house price is set to climb by 42.7% to $1.049 million.

So, is this the right time to invest? Let’s find out below:

The housing market is witnessing a widening chasm between new and established properties. Build prices have skyrocketed by at least 30% over the past two years.

Imagine constructing a 45 sq. house, once priced at $650k, now costing around $850k. While new properties come with enticing stamp duty concessions and government grants, they also carry a hefty premium, often 40% more expensive than existing homes. In times like this, it is not favourable to go for brand new houses. Wise decision would be to buy already established houses for a better yield and growth.

So, now the question arises, why the property market of Australia is witnessing sudden shift and surge in terms of prices? Here are some of the reasons listed below:

- The Resurgence of First Home Buyers

Rising rents, and tax adjustments fuel buyer confidence. Rumour has it that the Reserve Bank of Australia has signaled a shift from inducing economic pain to establishing a more stable interest rate environment. This newfound confidence is prompting first home buyers to re-enter the market, keen not to miss out on the opportunity amid escalating prices.

To be honest, the rumours of rate cuts are also circulating in the market and this news of rate cut is enough to drive the market. Let me help you understand this with an example; if I told you that, today your salary is going up by $30k, you will go out today and buy an expensive perfume, book a holiday, buy something nice for kids and wife, dine in an expensive restaurant and all of this hoopla even before your first pay check hits your bank account. Unfortunately that’s how the human sentiments work. Which means the news of the rate cut would be enough to drive people to buying more properties and increasing their risk appetite.

Do you remember RBA governor making a statement that rates won’t go up until 2024 and what it did to the market? Did it exploded with new entrees in the market or not? See the market doesn’t care what the real decision is, they respond to the sentiments first!

If we try to understand why will RBA cut the rates we need to understand what their intentions were in the first place. RBA wanted people and businesses to slow down their spending and be responsible and in anticipation they wanted businesses to close down and unemployment to go up “responsibly”. What never has been RBA strong pursuit is; not overdoing these control mechanisms. Forty thousand businesses have gone under since the interest rate started rising and there are more coming. While the wage growth is coming down and unemployment is going up, RBA has done it again to over squeeze the market sentiments and financials which means the cut is now in evident. The question not about if the cut will happen, the question is when it will happen it will rewrite Australian Property history again.

Population Growth and Immigration: The Fuel to the Fire

Australia’s surging population, bolstered by an influx of skilled migrants, is amplifying the housing demand. It’s as if Australia is hosting the grandest housewarming party ever, with more people eager to secure their piece of the Australian dream. Australia’s net overseas migration hit a record high of 548,800 in the year to September. While this is expected to slow down in the coming years, migration remains a key driver of population growth and housing demand.

Bridging the Housing Shortfall Amid Labour Challenges

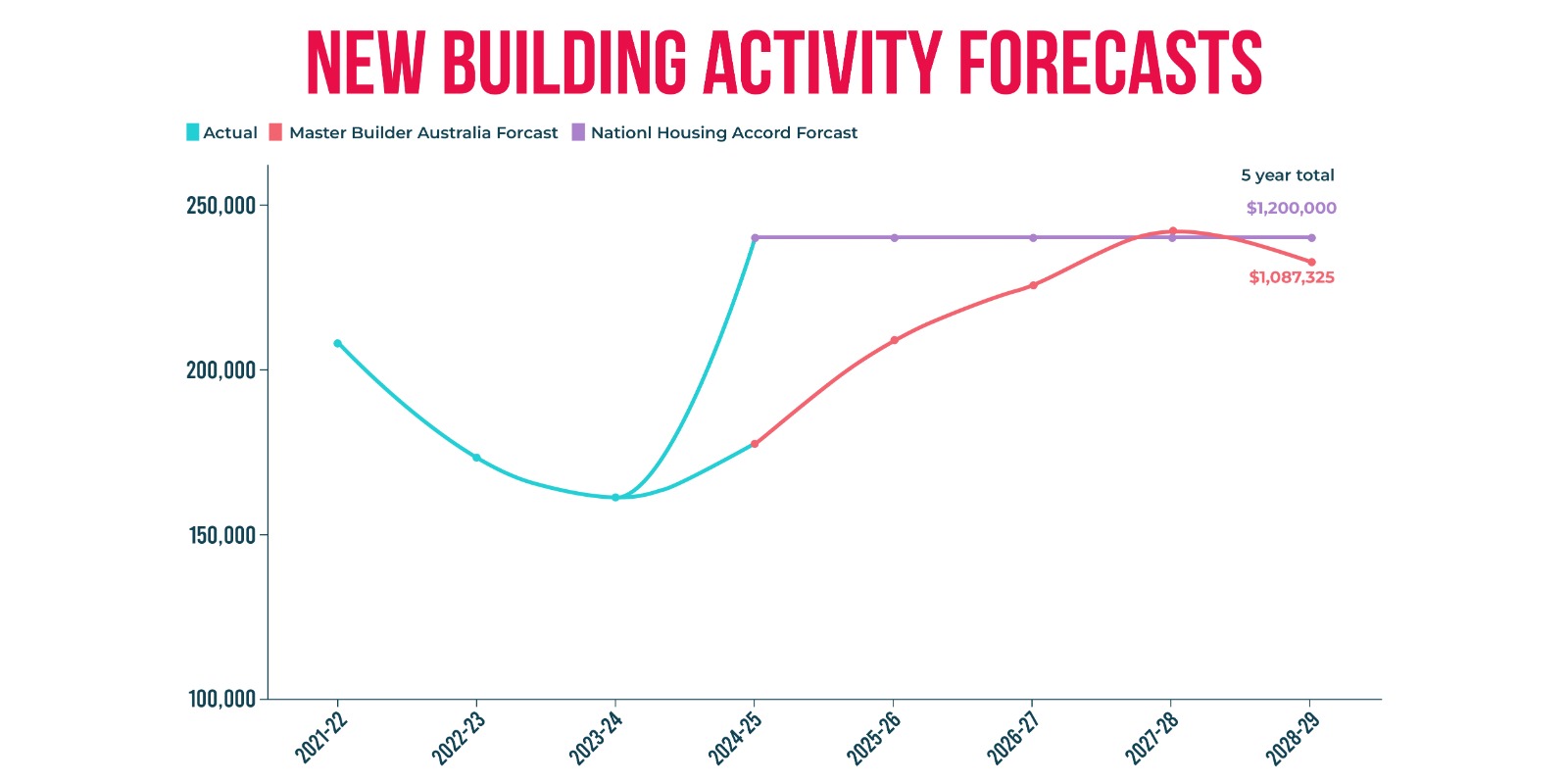

Despite ambitious targets to build 1.2 million new homes by mid-2029, Australia faces a staggering shortfall of over 110,000 homes. New home starts are projected at 1,087,325, falling short of the National Housing Accord’s target. Skilled labour shortages further compound the issue, with major projects syphoning tradespeople from the residential construction sector.

Policy and Immigration: Bridging the Disconnect

Political resistance to including tradespeople in skilled migrant streams actually reveals the gap between policy and industry needs. Streamlining immigration pathways for essential skilled workers is paramount to meeting construction targets and addressing the housing shortfall.

So, if you are one of those who can enter the market right now, what should be your first step?

Rentvesting and not the purchase of a place where you actually live.

Why?

Rentvesting is the perfect solution and as per the circumstances the best possible alternative investment strategy for a secured financial future.

Given the escalating costs, purchasing a property to live in might not be the wisest move right now. Rentvesting, the strategy of renting while investing in property, offers a compelling alternative. With an investment of $80k and a penchant for borderless investing, you can build a scalable property portfolio. Why settle for one property when you can acquire two or three, paving the way for generational wealth and a secure retirement?

Final Thoughts:

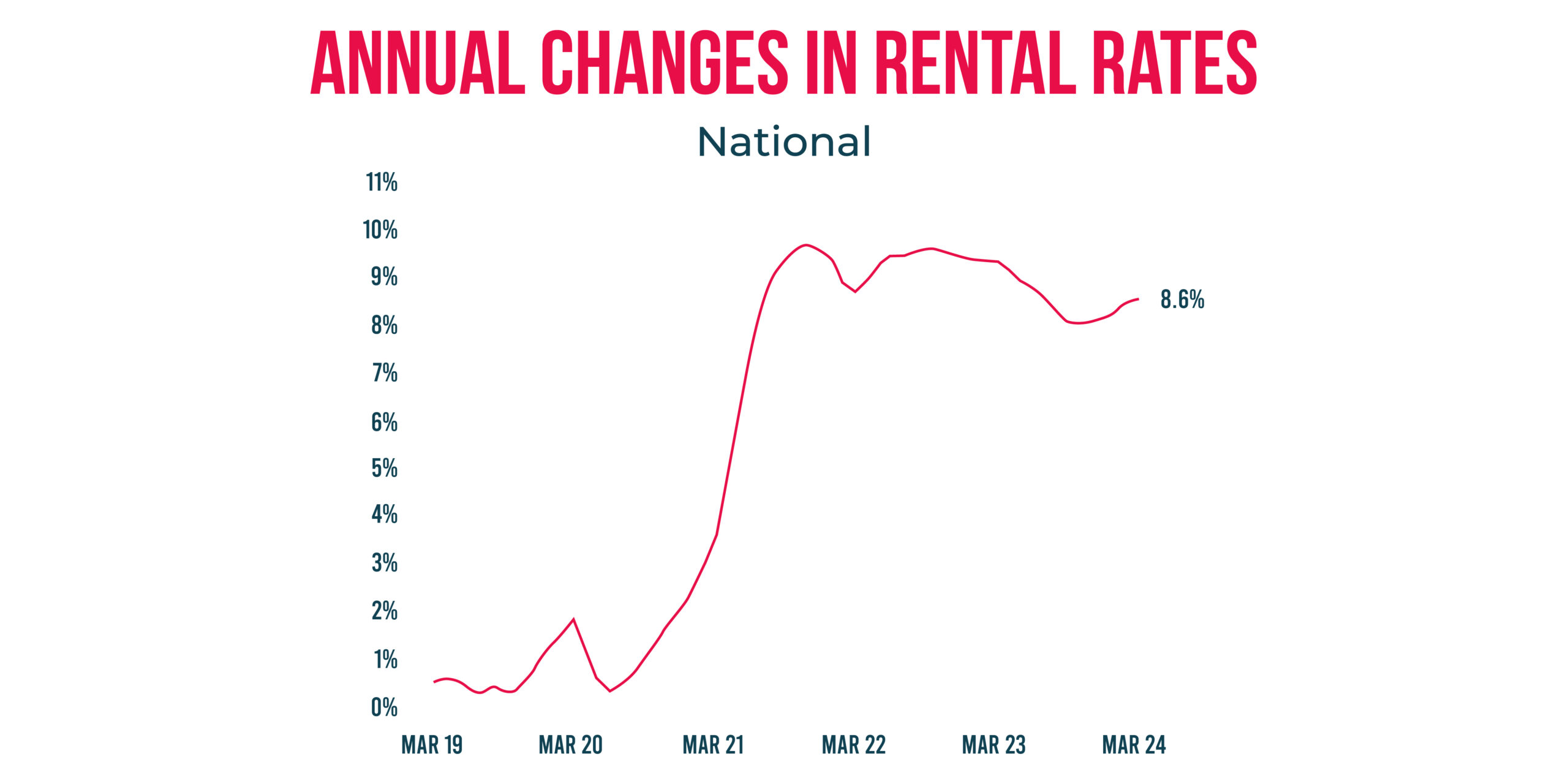

The property market is currently a magnet for investors, driven by rising property values and surging rents. With most cash rate hikes now behind us, and robust population growth amidst insufficient new dwelling supply, upward pressure on house prices and rents is anticipated throughout 2024.

Keep in mind that whether you plunge directly into the market or opt for a strategic approach like reinvesting, navigating Australia’s property rollercoaster demands a blend of understanding, anticipation, and boldness especially with the volatile conditions right now. It is high time to invest in established homes rather than opting for newly built homes considering the changing dynamics of the markets.

Happy and wise investing!