Building Balance and Wealth: One Investor’s Path to Property Success

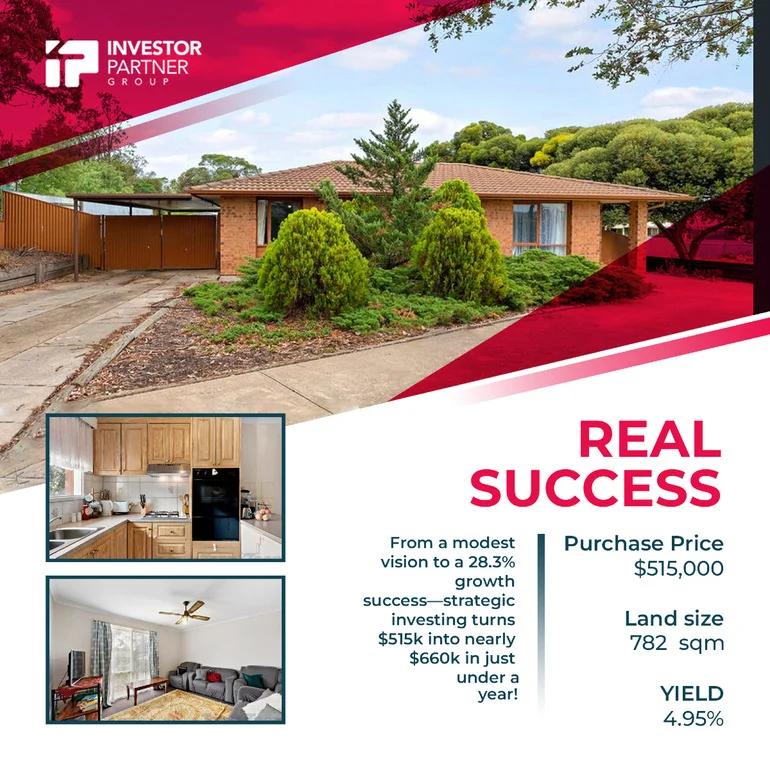

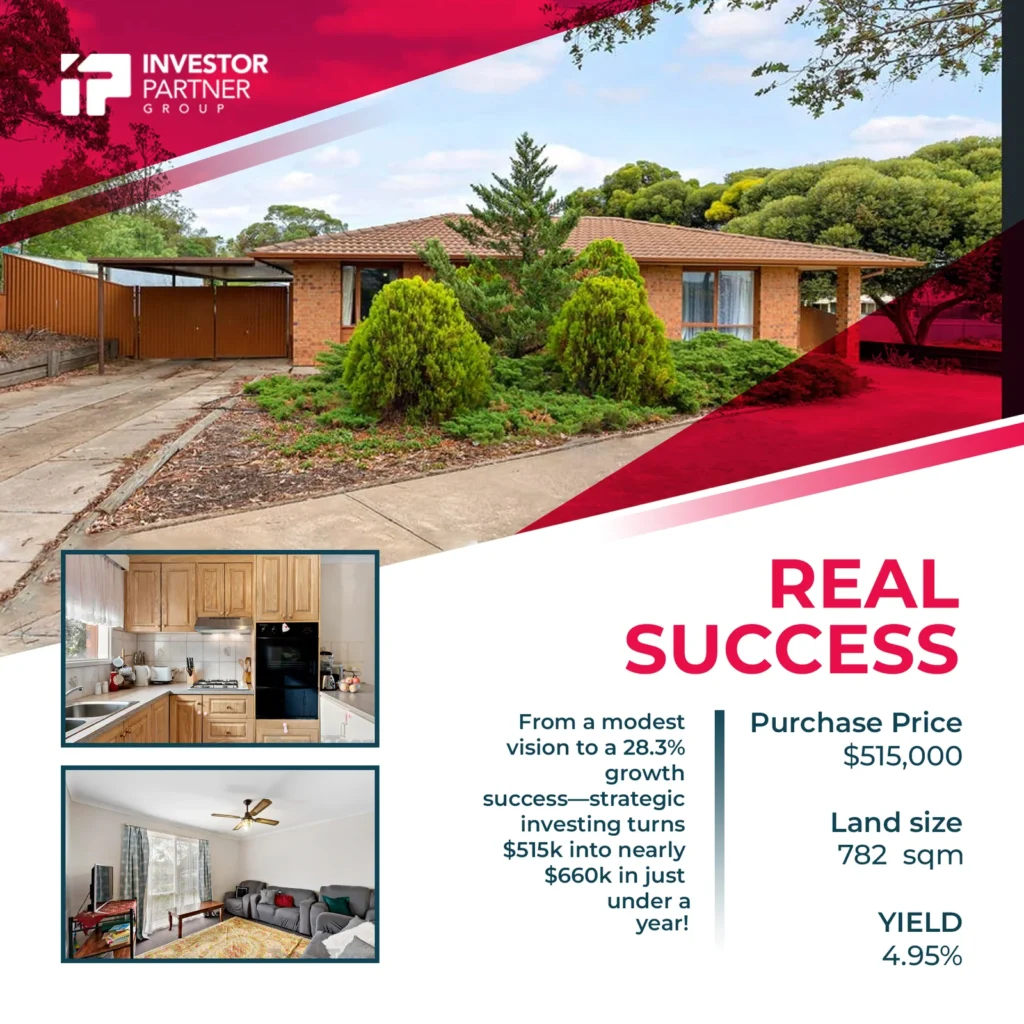

Purchase Price

$555,000

Est Value

$168,000

Land Size

689 sqm

Yield

6.51%

Success in property investment isn’t always about working harder—it’s about working smarter. This Perth property growth story highlights the journey of a high-income earner who spent years chasing returns in property development with limited success. Realizing the need for change, she embraced a strategic approach that transformed her portfolio and paved the way for lasting financial freedom.

When we met her, it was clear her strategy needed a complete overhaul. Instead of focusing solely on development projects, we shifted her approach to include a mix of growth-oriented and cash-flow-positive properties. This involved leveraging her SMSF for secure asset acquisition while structuring her personal portfolio for immediate returns and future growth. The goal wasn’t just financial—it was also about creating work-life balance and turning property investment into a tool for freedom, not stress.

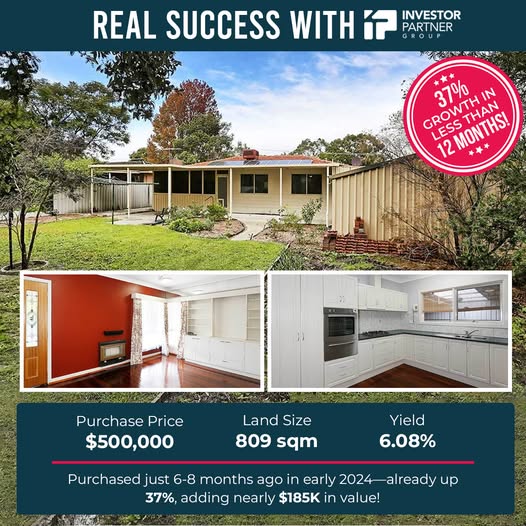

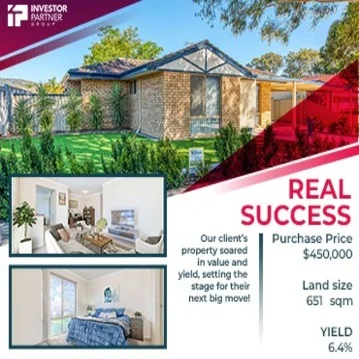

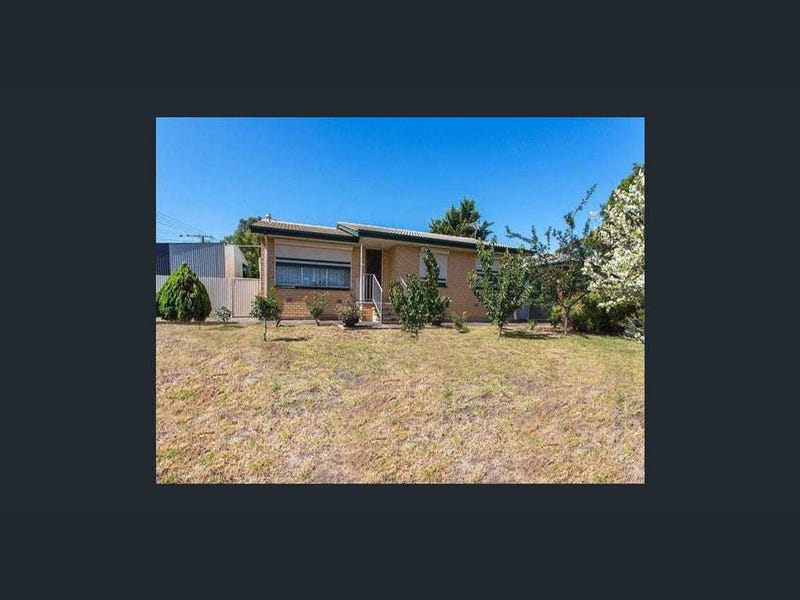

In mid-2024, she acquired a standout property in Metro Perth for $555,000. The results speak for themselves: within months, the property’s value soared by 30.27%, reaching nearly $168,000 in growth. And that’s not all. The property, set at 689 sqm, offers incredible potential for further development, including adding a granny flat or a second dwelling at the back. It’s an ideal rental property with five bedrooms, two bathrooms, and a backyard that opens directly onto a park. Initially rented at $650 per week, the income has since increased to $695 per week, pushing the yield from 6.09% to 6.51%—a perfect balance of growth and cash flow.

But why this property? The location was a key factor. Just 22 km from Perth CBD, it offers easy access to schools, parks, shopping centres, and a train station within walking distance. Major roads just minutes away connect directly to the city, making it a dream for families and commuters alike. Beyond the convenience, the data tells a compelling story. The demand-supply ratio of 59 highlights the scarcity of available properties, while the average days on the market have dropped to under 24 from 86 previously. Stock on the market is critically low at 0.15%, and with 28% of the population renting and a vacancy rate of 0.17%, the property is positioned perfectly in a high-growth corridor.

This purchase was more than an investment—it was a turning point. With this acquisition and subsequent additions to her portfolio, she is now on track to generate $100,000 in net passive income annually, alongside a development deal set to bring in another $150,000 per year. Most importantly, she’s creating the balance she’s always dreamed of, using property investment as a vehicle to shape a brighter future.

This success story is a testament to what’s possible with the right strategy and a willingness to adapt. If you’re ready to reimagine your property journey, let’s chat. Until the next purchase—peace out!