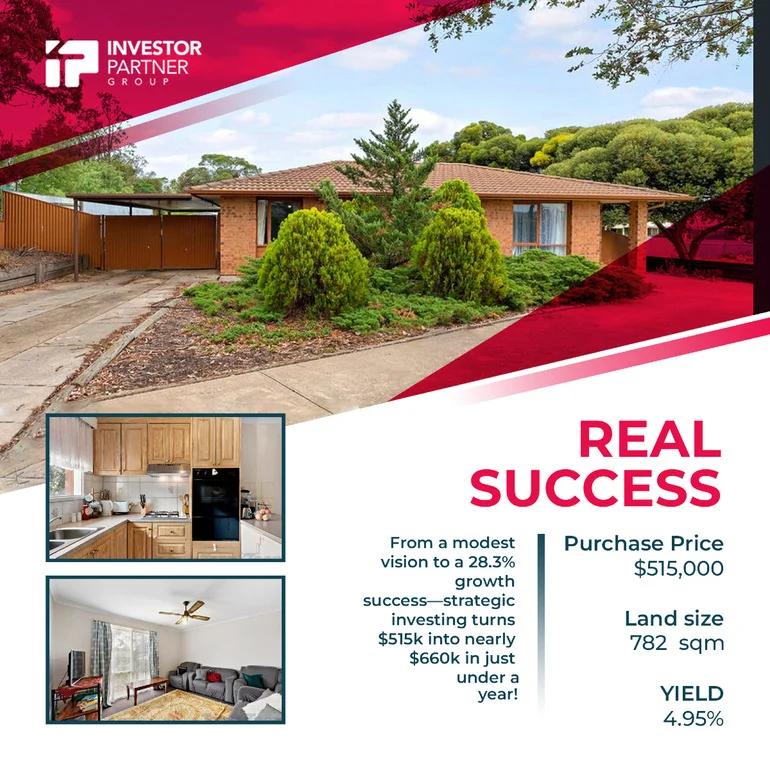

Smart Investments, Big Results: A $156K Equity Boost Story

Purchase Price

$525,000

Est Value

$681,000

Land Size

684 sqm

Yield

5.89%

Sometimes, a simple goal can lead to an extraordinary transformation. When our client approached us, his objective was to pay off his home loan as quickly as possible. Despite having a stable income and some equity in his principal residence, he faced significant challenges. He felt stuck with almost no borrowing capacity and limited knowledge of how to leverage his financial position. That’s where we stepped in.

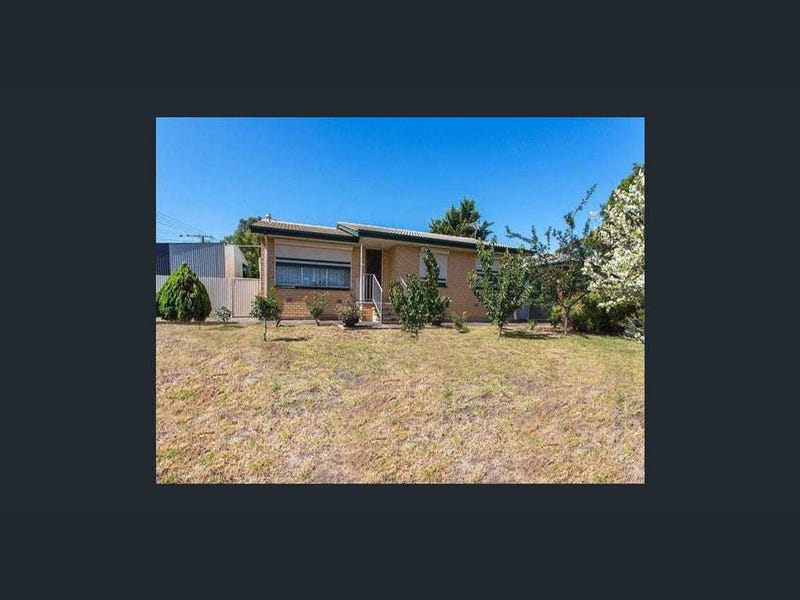

We crafted a tailored strategy that split his focus into two key areas: maximizing growth through his super fund and leveraging his personal property portfolio to generate cash flow and reduce debt. The first step involved acquiring a fully renovated property in Metro Perth for $525,000, set on a 684 sqm lot. This property, added to his super portfolio, has already grown by 29.7%, increasing in value by almost $156,000. With a rental yield of 5.89%, generating $600 per week, the property isn’t just growing—it’s producing consistent cash flow.

But we didn’t stop there. To supercharge his journey, we incorporated a super cash-flow property in his trust, bringing in an additional $20,000 annually. This strategic addition cut more than 10 years off his home loan repayment timeline, putting him on the fast track to financial freedom. The plan also included an equity refinance strategy to build further cash flow in his portfolio, creating a stable foundation for future growth.

The property itself offers immense potential. With room to add a granny flat or create an extra bedroom for just $2,000, it’s primed for even more value increases. Its location—just 15 km from Perth CBD—is ideal for families and commuters alike, with schools, parks, a shopping centre, and a train station just minutes away. Additionally, the renters’ proportion of 34% in the area highlights a strong demand for rental properties, ensuring consistent occupancy. This demand is further underscored by the stock on the market being critically low at less than 0.2%, making this a high-demand, high-value area.

As part of a high-growth corridor, the area also boasts a demand-supply ratio of 63, properties selling in 22 days compared to 74 previously, and a vacancy rate of just 0.11%. Our strategy for him didn’t just focus on a single property; it was about creating a scalable, repeatable system. This particular property is already set to be sold in 2025, with the proceeds reinvested into further growth opportunities. By aligning his financial goals with smart property investments, we’ve turned what seemed like a distant dream into a tangible, achievable reality.

This success story is a testament to the power of strategy and expert guidance. If you’re ready to take control of your financial future, let’s chat property. Until the next success story—peace out!