Investing In SMSF: Unlocking Growth Potential and Yield in Perth

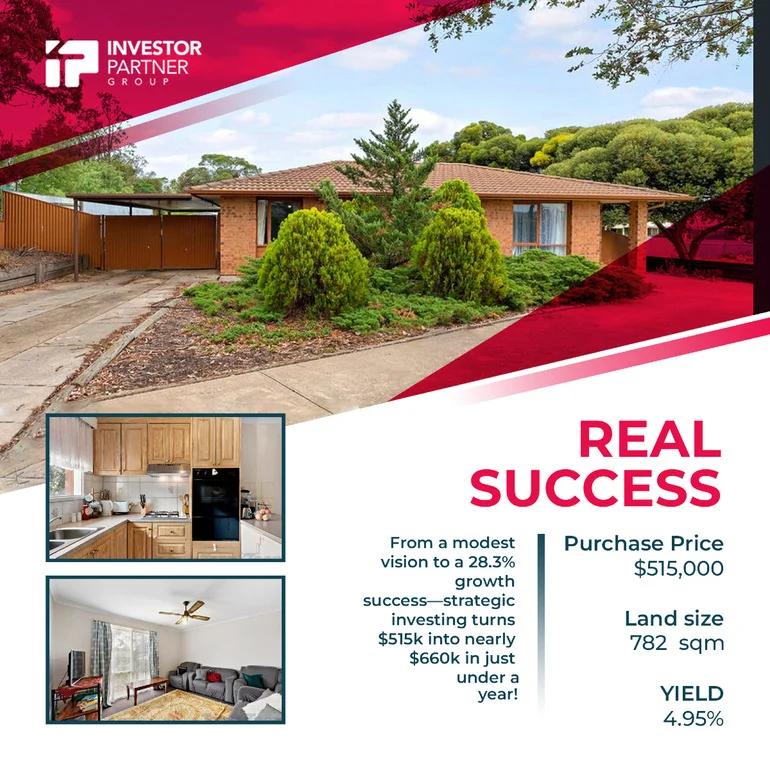

Purchase Price

$515,000

Est Value

$580,000

Land Size

678 m²

Yield

5.96%

Investing in a Self-Managed Superannuation Fund (SMSF) requires careful consideration of multiple factors to ensure both growth and yield.

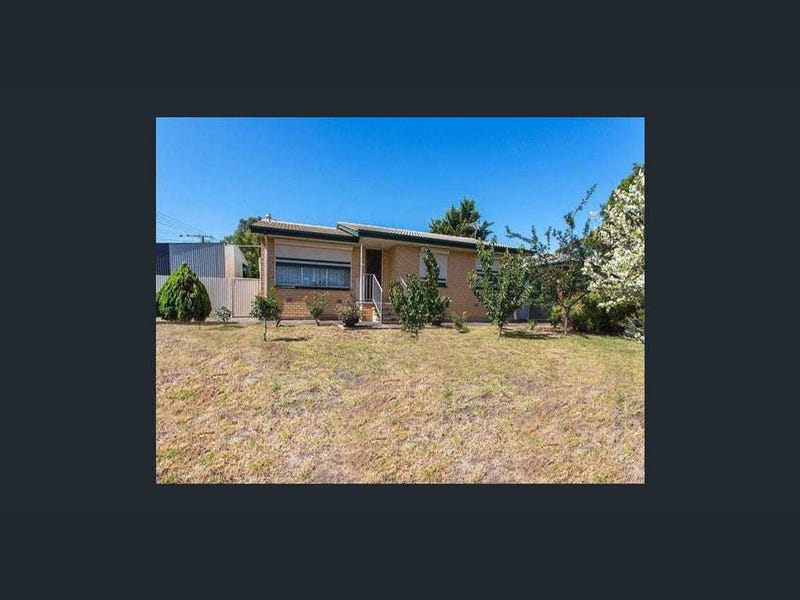

Our client, a young family with a high income, sought to diversify their SMSF portfolio by acquiring an off-market property in a homeowner-dominated pocket of metropolitan Perth. With only $130,000 in their superannuation fund, they embarked on a strategic journey that promised not only substantial growth potential but also the opportunity to increase yields significantly.

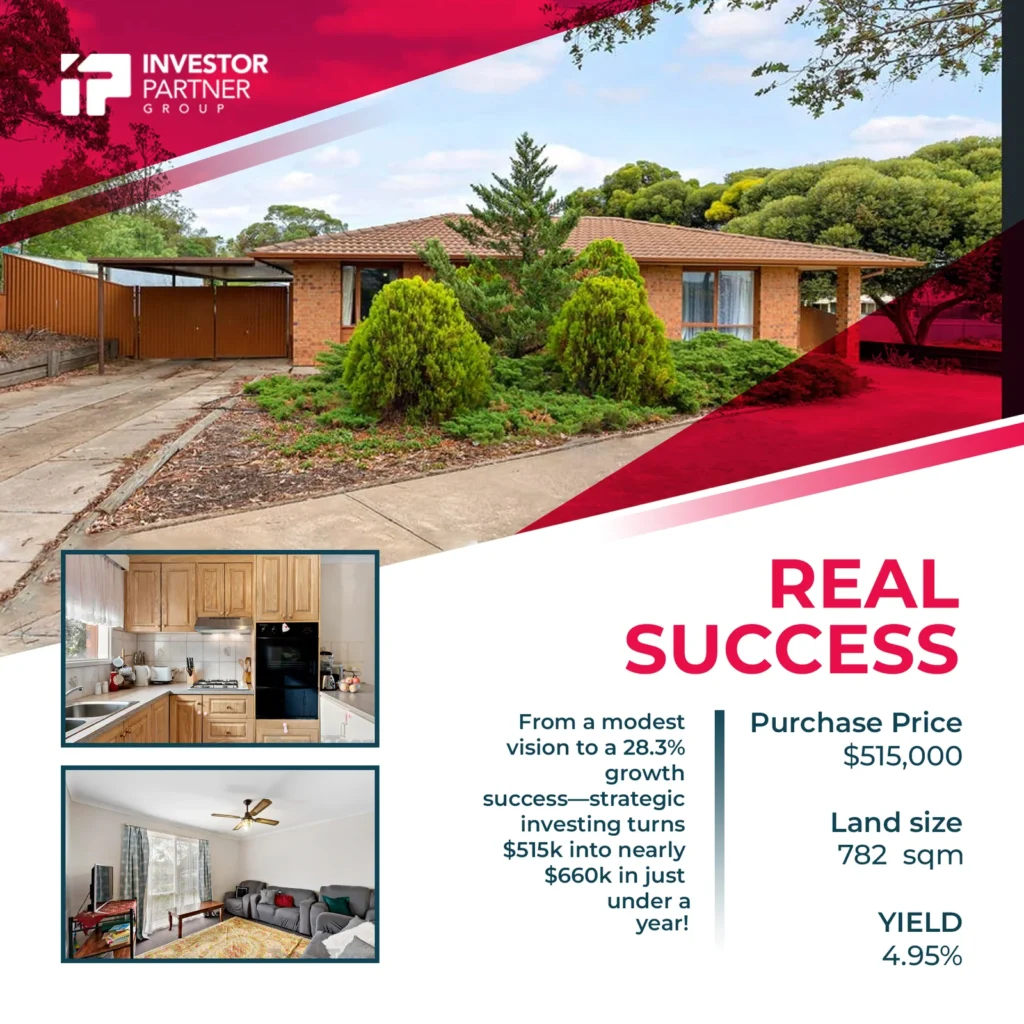

The property in question was purchased for $515,000, boasting a rental income of $590 per week, which equates to a respectable 5.96% yield.

However, the astute investors identified that the property has the potential to boost this yield to an impressive 7.6% by small & modest renovations costing approximately $15,000 by converting the property into a 3-bedroom, 1-bathroom unit with an additional self-contained unit.

One key indicator of the property’s investment potential is the suburb’s median property price of $620,000, with similar properties in the vicinity selling at an average of $580,000. This price differential presents a significant opportunity for future capital growth, as the property is ideally situated right in front of the beach.

The location offers a host of amenities within a 5-minute walk, including schools, hospitals, childcare facilities, and church, making it an attractive proposition for tenants and potential future buyers.

Furthermore, the property is conveniently located around the corner from a major shopping center, further enhancing its appeal to both residents and investors. Its proximity to the beach, a highly sought-after feature for many homebuyers, adds another layer of attractiveness to the property, increasing its long-term potential for capital growth.

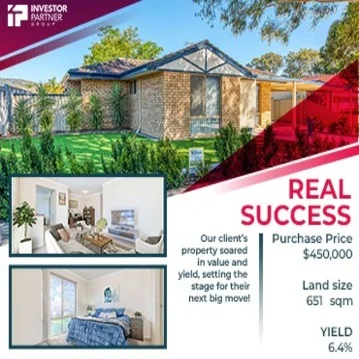

We carefully crafted the investment strategy for this particular property to strike a balance between growth and yield. While the earlier acquisitions of the client had contributed to portfolio growth, they had not significantly improved yields.

Recognizing the need to safeguard against rising interest rates and protect the overall portfolio without compromising their lifestyle, the investors prioritized growth in this SMSF property. This decision aligns with the understanding that long-term growth is a crucial component of SMSF investment, ensuring the financial security of the investors in retirement.

The data supporting the choice of this property as a growth corridor is compelling. With less than 1.1% of properties on the market, the competition among buyers and renters is intense. The 19.7% proportion of renters in the area indicates a strong rental market, aligning with the investors’ strategy to enhance yields.

Wrapping it up, the acquisition of this off-market property in metropolitan Perth’s growth corridor represents a shrewd investment decision within an SMSF. Our prestigious client has not only tapped into the potential for substantial capital growth but has also devised a strategy to increase yields significantly, safeguarding their financial future. With a carefully curated blend of growth and yield, this SMSF investment stands as a testament to the prudence and foresight of its owners in navigating the complex landscape of property investment.